트럼프 관세, 글로벌 스테인리스 시장 흔들어 2025.04.14

2025년 4월 초, 글로벌 스테인리스 스틸 시장은 두 가지 주요 정책 변화로 흔들렸습니다. 한편으로는 미국 도널드 트럼프 대통령이 국내 제조업체를 보호하기 위해 수입 스테인리스 스틸 제품에 대한 새로운 관세 부과를 발표했고, 다른 한편으로는 중국이 사실상 규제 정책을 공식적으로 시작했습니다. "비공식"(대리 구매) 수출 관행을 금지합니다.특히 스테인리스강 부문에서 이러한 이중 충격이 발생했습니다. 이러한 이중 충격은 급격한 가격 변동을 촉발하고, 무역로 재편을 강요했으며, 글로벌 공급 전략의 재편을 가속화했습니다.

I. 중국의 가격 하락: 관세와 수출 제한의 이중적 영향

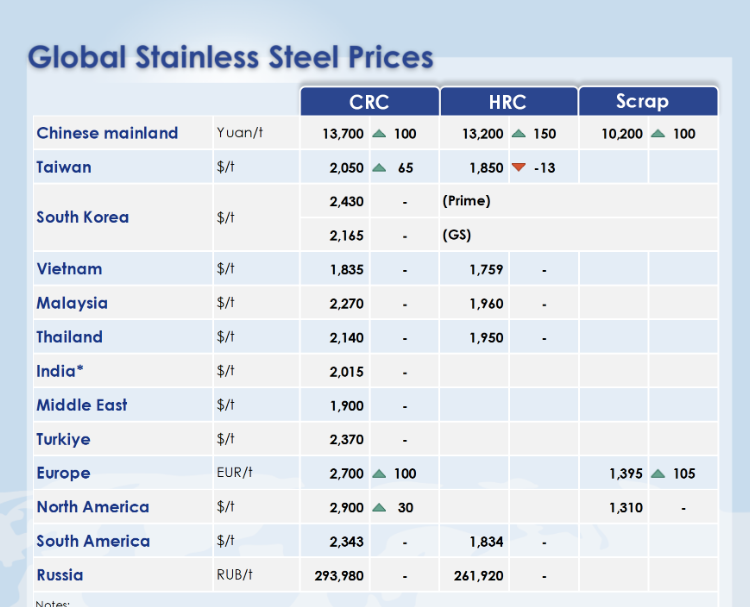

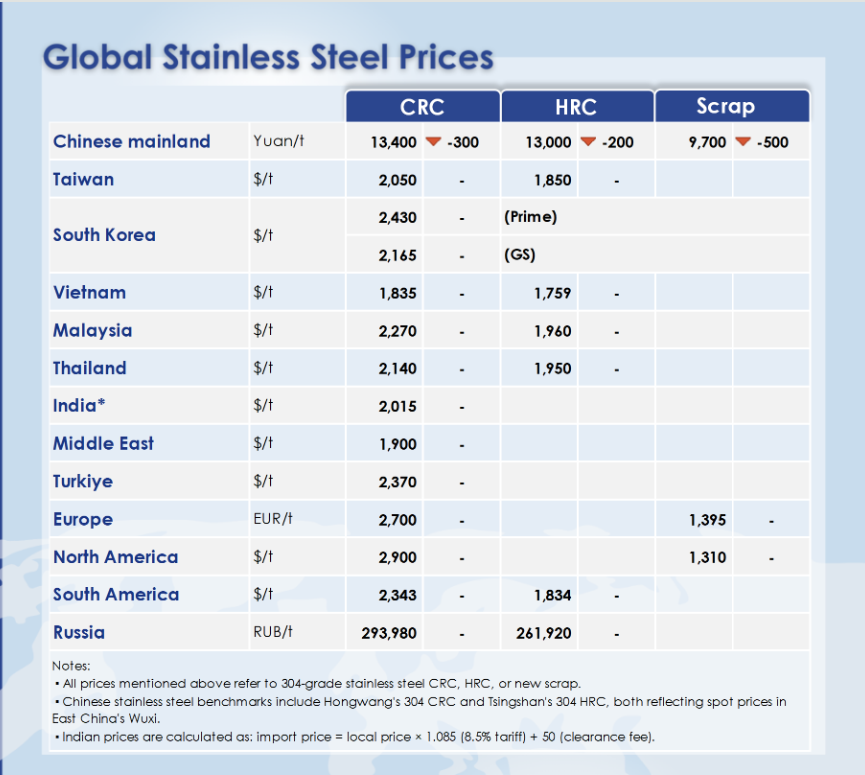

아래는 정책 변경 전후의 중국 국내 스테인리스 스틸 가격을 비교한 것입니다(단위: 위안/톤):

| 제품 유형 | 3월 25일~4월 1일 | 4월 2일 이후 | 변화 |

|---|---|---|---|

| CRC | 13,700 | 13,400 | ▼300 |

| HRC | 13,200 | 13,000 | ▼200 |

| 권투 시합 | 10,200 | 9,700 | ▼500 |

관세 발표로 인해 미국으로 향하는 수요 감소로 인해 예상했던 하락세가 나타났지만, 더 큰 영향은 중국의 비공식 수출 채널에 대한 제한에서 비롯되었습니다.역사적으로 많은 소규모 거래자들이 적절한 문서화나 수출 자격 없이도 해외로 제품을 배송할 수 있었습니다.

II. "대리구매" 수출의 종말: 소규모 수출업체의 전환점

자격 미달 무역업체가 다른 회사 명의로 상품을 수출하는 "대리구매" 수출은 중국의 스테인리스 스틸 수출 모델에서 오랫동안 흔한 관행이었습니다. 정부는 이제 이러한 관행을 엄격히 금지하고 있습니다.

유효한 수출 허가증이 없는 거래자는 해외 배송 능력을 잃다;

저가제품의 상당부분은 국내 시장에 머물러 있다, 가격 경쟁이 심화됨

규정 준수 역량을 갖춘 자격을 갖춘 수출업체는 더 큰 영향력을 얻게 됩니다.이는 시장 통합으로 이어진다.

III. 글로벌 바이어의 전략적 대응: 위험과 기회

중국산 스테인리스 스틸에 대한 의존도가 높은 구매자를 위해:

공급업체가 적절한 수출 자격을 갖추고 있는지 즉시 확인하십시오. 통관 문제를 피하기 위해;

조달을 다음으로 전환 규모가 더 크고 확립된 수출업체 강력한 규정 준수 실적을 갖추고 있음

혜택을 받을 준비를 하세요 시장 변동이를 통해 최고 공급업체와의 가격 경쟁이 개선될 수 있습니다.

유럽, 중동 및 중립 시장의 구매자를 위한 정보:

활용하세요 일시적으로 낮은 중국 가격 단기 계약을 체결하다

사용을 고려하세요 제3국 환적 허브태국이나 베트남과 같은

결제 및 통관 경로가 최적화되었는지 확인하세요. 위험 완화.

다국적 조달팀의 경우:

실시하다 규정 준수 기반 공급업체 감사 모든 소싱 시장에서

지역 소싱 허브 구축을 탐색하세요. 말레이시아, 인도네시아 또는 중동;

미국의 관세와 중국의 정책 영향에 따라 공급 비율을 전략적으로 재분배하여 전 세계적인 연속성을 유지합니다.

IV. 결론: 업계 재편이 시작되었다

트럼프의 관세 조치와 중국의 수출 규제는 공동으로 글로벌 스테인리스 스틸 시장 재편. 단기 가격 변동성은 불가피하지만, 장기적 추세는 투명성, 규정 준수 및 공급망 통합을 선호할 것입니다..

전 세계 스테인리스 스틸 구매자들에게 이는 중요한 순간을 의미합니다. 단순히 도전이 아니라, 공급망을 업그레이드하고, 장기적으로 비용 이점을 확보하고, 규제된 무역의 새로운 시대에 적응할 수 있는 기회이기도 합니다.

메모:

위에 나열된 가격은 304급 스테인리스 스틸 CRC, HRC 또는 스크랩에 적용됩니다. 중국에서 스테인리스 스틸 벤치마크는 Hongwang의 304 CRC와 Tsingshan의 304 HRC를 기준으로 하며, 이는 중국 동부 우시의 현물 가격을 반영합니다. 인도의 가격 공식은 다음과 같습니다. 수입 가격 = 현지 가격 x 1.085(8.5% 관세) + 50(통관 수수료).

가격 데이터의 출처는 다음과 같습니다.