Trumps Zölle erschüttern globalen Edelstahlmarkt 2025.04.14

Anfang April 2025 wurde der Weltmarkt für rostfreien Stahl durch zwei wichtige politische Veränderungen erschüttert: Einerseits kündigte US-Präsident Donald Trump eine neue Welle von Zöllen auf importierte Edelstahlprodukte an, um die heimischen Hersteller zu schützen; andererseits führte China offiziell eine Regulierungspolitik ein, die effektiv Verbot von Exportpraktiken unter dem Tisch" (buy-on-behalf)vor allem im Bereich des rostfreien Stahls. Diese doppelten Schocks haben zu starken Preisschwankungen geführt, eine Neuausrichtung der Handelswege erzwungen und die Umstrukturierung der globalen Lieferstrategien beschleunigt.

I. Chinas Preisverfall: Doppelte Auswirkungen von Zöllen und Exportbeschränkungen

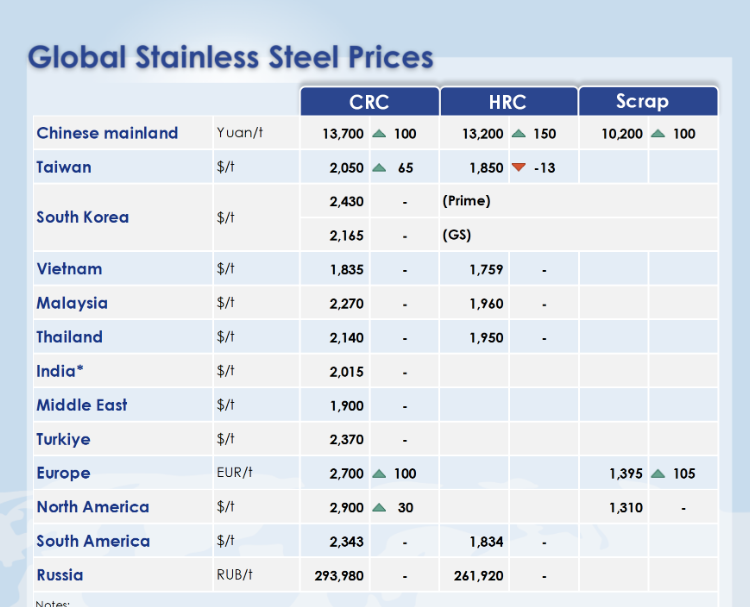

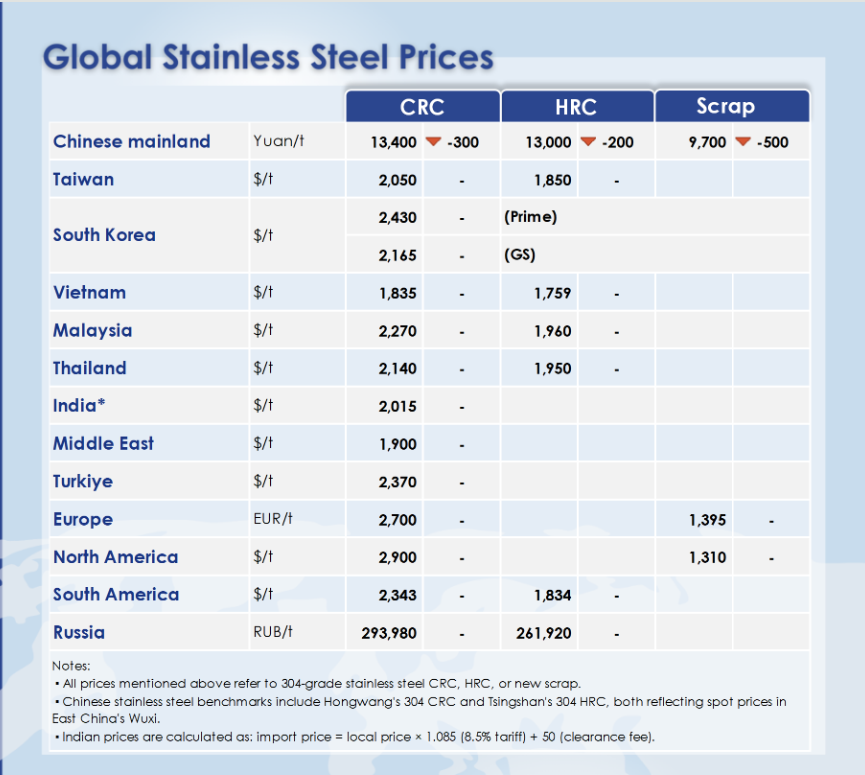

Nachstehend ein Vergleich der chinesischen Inlandspreise für rostfreien Stahl vor und nach den politischen Änderungen (Einheit: Yuan/Tonne):

| Produkttyp | 25. März - 1. April | Post-Apr 2 | Ändern Sie |

|---|---|---|---|

| CRC | 13,700 | 13,400 | ▼300 |

| HRC | 13,200 | 13,000 | ▼200 |

| Schrott | 10,200 | 9,700 | ▼500 |

Die Ankündigung der Zölle führte zwar zu einem erwarteten Rückgang aufgrund der schrumpfenden Nachfrage aus den USA, die stärksten Auswirkungen hatte Chinas Beschränkung der informellen Exportkanäledie es in der Vergangenheit vielen kleineren Händlern ermöglichte, Produkte ohne ordnungsgemäße Unterlagen oder Ausfuhrgenehmigungen ins Ausland zu versenden.

II. Das Ende der "Buy-on-behalf"-Exporte: Ein Wendepunkt für kleine Exporteure

"Buy-on-behalf"-Exporte - bei denen unqualifizierte Handelsunternehmen Waren unter dem Namen eines anderen Unternehmens exportieren - sind im chinesischen Exportmodell für rostfreien Stahl schon lange üblich. Die Regierung verbietet solche Praktiken nun strikt:

Händler ohne gültige Ausfuhrlizenzen werden ihre Fähigkeit verlieren, nach Übersee zu liefern;

Ein erheblicher Teil der Niedrigpreisprodukte wird auf dem heimischen Markt stecken bleibendie Verschärfung des Preiswettbewerbs;

Qualifizierte Exporteure, die in der Lage sind, die Vorschriften einzuhalten, werden mehr Einfluss gewinnenund führt zu einer Marktkonsolidierung.

III. Die strategische Antwort der globalen Einkäufer: Risiko und Chance

Für Käufer, die stark von chinesischem Edelstahl abhängig sind:

Überprüfen Sie sofort, ob Ihr Lieferant über die erforderlichen Exportqualifikationen verfügt. um Abstandsschwierigkeiten zu vermeiden;

Umstellung der Beschaffung auf größere, etablierte Exporteure mit einer starken Erfolgsbilanz bei der Einhaltung der Vorschriften;

Bereiten Sie sich darauf vor, von folgenden Vorteilen zu profitieren Marktverwerfungenwas die Preisgestaltung gegenüber den Top-Lieferanten verbessern kann.

Für Käufer in Europa, dem Nahen Osten und den neutralen Märkten:

Nutzen Sie die Vorteile vorübergehend niedrige chinesische Preise um kurzfristige Verträge abzuschließen;

Erwägen Sie die Verwendung von Umschlagplätze in Drittländernwie Thailand oder Vietnam;

Sicherstellen, dass die Zahlungs- und Zollwege optimiert sind für Risikominderung.

Für multinationale Beschaffungsteams:

Durchführen einer Prüfung der Einhaltung der Vorschriften durch die Lieferanten über alle Beschaffungsmärkte hinweg;

Sondierung der Einrichtung von regionalen Beschaffungszentren in Malaysia, Indonesien oder der Nahe Osten;

Strategische Umverteilung des Angebots auf der Grundlage der Auswirkungen der US-Zölle und der chinesischen Politik, um die globale Kontinuität zu wahren.

IV. Schlussfolgerung: Eine Umstrukturierung der Branche hat begonnen

Trumps Zölle und Chinas harte Gangart bei Exporten sind gemeinsam Umgestaltung der globalen Edelstahllandschaft. Kurzfristige Preisschwankungen sind zwar unvermeidlich, der langfristige Trend geht in Richtung Transparenz, Einhaltung der Vorschriften und Konsolidierung der Lieferkette.

Für die weltweiten Einkäufer von rostfreiem Stahl ist dies ein entscheidender Moment - nicht nur eine Herausforderung, sondern auch eine Chance, die Lieferantennetzwerke zu verbessern, langfristige Kostenvorteile zu sichern und sich auf eine neue Ära des regulierten Handels einzustellen.

Anmerkung:

Die oben aufgeführten Preise beziehen sich auf Edelstahl der Sorte 304 CRC, HRC oder Schrott. In China basieren die Benchmarks für rostfreien Stahl auf 304 CRC von Hongwang und 304 HRC von Tsingshan, die die Spotpreise in Wuxi, Ostchina, widerspiegeln. Für Indien lautet die Preisformel: Einfuhrpreis = lokaler Preis x 1,085 (8,5% Zoll) + 50 (Abfertigungsgebühr).

Die Preisdaten stammen von: